Being Too Conservative Can Be Risky: Targeting a Higher Rate of Return

Last month we got into the numbers and formulas of Time Value of Money, and you know I love that stuff. But sometimes the math can over-complicate a subject that is actually pretty simple.There are two paths that lead to accumulating enough money to retire comfortably. The first path is: You save a lot of money each year, do that for a long time, and watch your savings pile up. If you save $100,000 per year for 30 years and put it under your mattress, you’ll have $3M saved up for retirement.But for many families, saving that much money each year is not in the cards. The second path -- the one that most people need to take -- is an approach that requires disciplined saving, aggressive investing and strategic planning.The problem people run into is when they don’t save enough each year and they adopt a low rate-of-return investing strategy (think bonds). It seems “low-risk” because they’re avoiding risking the money they have. But in another sense it’s very risky, because it jeopardizes their ability to retire.

Targeting a Higher Rate of Return

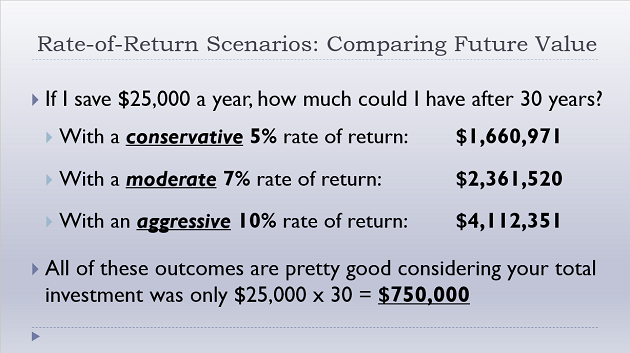

Let’s look at three scenarios. They each involve saving $25k per year. The only difference is your expected rate of return over a 30-year time horizon. If you can’t save $100k per year, you can still get to $3M in 30 years with a more aggressive portfolio. (The exact target rate of return to get to $3M by saving $25k per year is 8.3%, FYI.)Of course, in the real world, you can’t lock in a specific rate of return for 30 years unless you stick to super low-risk investments like bonds or CDs, which usually top out around 2-3% per year. To get closer to that 8-10% rate of return, you’ll need to invest in riskier assets, like stocks.Different paths, to be sure, but similar outcomes. The choice is yours as to whether you want to do more of the work by saving, or whether you want your investments to do more of the work by growing.

If you can’t save $100k per year, you can still get to $3M in 30 years with a more aggressive portfolio. (The exact target rate of return to get to $3M by saving $25k per year is 8.3%, FYI.)Of course, in the real world, you can’t lock in a specific rate of return for 30 years unless you stick to super low-risk investments like bonds or CDs, which usually top out around 2-3% per year. To get closer to that 8-10% rate of return, you’ll need to invest in riskier assets, like stocks.Different paths, to be sure, but similar outcomes. The choice is yours as to whether you want to do more of the work by saving, or whether you want your investments to do more of the work by growing.

Takeaway:

To have enough for retirement, you either need to:

Save a ton of money, -or- Invest more aggressively.

We’ll talk more about risk next month, including a strategy that may be able to reduce some of the risks inherent in stock investing.