Fully Invested.

Newsletter articles and blog posts to help you navigate the markets.

Help Yourself Make a Change

Big changes aren’t easy for anyone, whether pivoting to a new career, ending a relationship, or starting a new fitness regimen.But one of the tried and true ways to navigate transitions is by establishing a new routine. Routines provide structure during periods of change, structure that helps us let go of the previous chapter and feel like we’ve truly begun the new chapter.So how can someone change their financial routine to help improve their retirement prospects?In his book “The ONE Thing,” Gary Keller reviews a wealth of research on habit formation. I’ve gone back to this book so many times that I decided to show you my well-worn version with flags, notes, stains and all: Unfortunately, Keller found that for most of us, the hardest part is actually forming the new habit. “Habits require much less energy to maintain than to begin,” he says. In the beginning, before a habit is successfully established, you need to rely on willpower and discipline to stick to the new routine. But if you are able to do so for long enough, the new behavior becomes automatic or ingrained.In an experiment on establishing new habits for diet and exercise, researchers found that the average person took 66 days to adopt new daily behaviors. “It takes time to develop the right habit, so don’t give up too soon,” Keller encourages his readers.Last month I wrote about evaluating your investing plan. And if you’re like most people, you probably discovered that a higher rate of return could really help you meet your financial goals. (Long-time readers know that I’m a firm believer in the long-term wealth-building power of the stock market, and you can read more of my thoughts on targeting a higher rate of return here.)But if you are a conservative investor, this may sound scary.So how can you establish and then maintain the habit of investing in stocks?One of my favorite tricks for creating a new financial routine is automated investing. The hardest part about changing directions is making the decision and then sticking with it. With automated investing, all you have to do is make the decision. The automation then provides the discipline, willpower & routine for you.Here’s how you do it…First, take a look at all of your accounts, and divide your investments into two big categories -- high risk / high expected return and low risk / low expected return. Said another way, divide them into Stocks and Bonds/Cash.Second, take a look at the contributions you’re making to your retirement plans, whether a 401k or IRA or other type of account. What percentage of your monthly contributions are going into Stocks? What percentage of your contributions are going into Bonds/Cash?Now we’re at decision time. If you need to grow your Stocks category, increase the percentage of contributions (i.e. new money) you’re adding to the Stocks category. (If you’ve discovered you’re a little too heavy in Stocks, you can do the opposite and increase the contributions you’re making to Bonds/Cash.)Automatically adding a little bit more to stocks -- just a little bit at a time -- is one of those habits that can add up to a lot over time. Consider that a conservative $100,000 portfolio that grows at 4% per year will grow to about $219,112 after 20 years. A slightly more aggressive portfolio that grows at 6% per year will grow to about $320,714 after 20 years.When you put it in dollar terms, investing in stocks is a habit that’s worth establishing.

Unfortunately, Keller found that for most of us, the hardest part is actually forming the new habit. “Habits require much less energy to maintain than to begin,” he says. In the beginning, before a habit is successfully established, you need to rely on willpower and discipline to stick to the new routine. But if you are able to do so for long enough, the new behavior becomes automatic or ingrained.In an experiment on establishing new habits for diet and exercise, researchers found that the average person took 66 days to adopt new daily behaviors. “It takes time to develop the right habit, so don’t give up too soon,” Keller encourages his readers.Last month I wrote about evaluating your investing plan. And if you’re like most people, you probably discovered that a higher rate of return could really help you meet your financial goals. (Long-time readers know that I’m a firm believer in the long-term wealth-building power of the stock market, and you can read more of my thoughts on targeting a higher rate of return here.)But if you are a conservative investor, this may sound scary.So how can you establish and then maintain the habit of investing in stocks?One of my favorite tricks for creating a new financial routine is automated investing. The hardest part about changing directions is making the decision and then sticking with it. With automated investing, all you have to do is make the decision. The automation then provides the discipline, willpower & routine for you.Here’s how you do it…First, take a look at all of your accounts, and divide your investments into two big categories -- high risk / high expected return and low risk / low expected return. Said another way, divide them into Stocks and Bonds/Cash.Second, take a look at the contributions you’re making to your retirement plans, whether a 401k or IRA or other type of account. What percentage of your monthly contributions are going into Stocks? What percentage of your contributions are going into Bonds/Cash?Now we’re at decision time. If you need to grow your Stocks category, increase the percentage of contributions (i.e. new money) you’re adding to the Stocks category. (If you’ve discovered you’re a little too heavy in Stocks, you can do the opposite and increase the contributions you’re making to Bonds/Cash.)Automatically adding a little bit more to stocks -- just a little bit at a time -- is one of those habits that can add up to a lot over time. Consider that a conservative $100,000 portfolio that grows at 4% per year will grow to about $219,112 after 20 years. A slightly more aggressive portfolio that grows at 6% per year will grow to about $320,714 after 20 years.When you put it in dollar terms, investing in stocks is a habit that’s worth establishing.

Evaluating Your Investing Plan

Sometimes it’s hard to know if you’re heading in the right direction.If you’re navigating your way through the physical world, modern technology offers lots of tools to help, and many of them fit in the palm of your hand.These tools are great, but you have to know how to use them. Some of my relatives still give directions with pen and paper!In investing, technology also offers many tools to help you determine if you’re on course.For most investors, the destination is retirement. Here’s a tool to help you see if your current investing plan is heading in the right direction.Excel has a really useful formula called future value. As investors, this allows you to estimate the future value of your portfolio, by inputting your current account value, current contribution rate, expected future rate of return, and how long you plan on working until you retire.Calculating Future Value Using the Excel FormulaLet’s calculate the future value of a portfolio for an investor who:

- Currently has $100,000 invested (Present Value, or PV);

- Expects to earn 5% on their investments annually (Rate of return, or rate);

- Is contributing an additional $6,000 per year to their accounts (Payment, or Pmt);

- And plans on working for another 10 years (Period, or Nper).

- If you are an Excel novice, don’t worry! We’re going to go step by step.

1. Open up a new workbook in Excel.2. Enter the following words and values in Columns A-B, rows 1-5. 3. In cell B5, type: =FV(You should see the future value formula pop up like this:

3. In cell B5, type: =FV(You should see the future value formula pop up like this: That formula is: FV(rate, nper, pmt, [pv], [type])Let’s pause and explain these acronyms for our example.FV – Future Value. What something could be worth in the future.Rate – Rate of return. The amount you expect your investments to grow each year, on average.Pmt – Payment. The amount of money you expect to save in a given period of time. You can choose any time period (year, month, week), but in this example we’ll use “year”.Nper – Number of periods. In our example, the number of years you expect to work and save money before you retire.PV – Present Value. The amount of money you currently have invested. You can omit this value and the formula will still work -- it will just assume that you don’t have any savings invested at the present time.Type – To keep it simple, we’re leaving this input blank in the example, meaning the formula will assume that you make your contributions at the end of each period. (If you make contributions at the beginning of each period, you can use “1” as your input.)Now, back in Excel, in cell B5, you had typed: =FV(4. With your cursor blinking after the open parenthesis in cell B5, take your mouse and click on cell B1, which has the value “5%” in it. Then type a comma.Your screen should look like this:

That formula is: FV(rate, nper, pmt, [pv], [type])Let’s pause and explain these acronyms for our example.FV – Future Value. What something could be worth in the future.Rate – Rate of return. The amount you expect your investments to grow each year, on average.Pmt – Payment. The amount of money you expect to save in a given period of time. You can choose any time period (year, month, week), but in this example we’ll use “year”.Nper – Number of periods. In our example, the number of years you expect to work and save money before you retire.PV – Present Value. The amount of money you currently have invested. You can omit this value and the formula will still work -- it will just assume that you don’t have any savings invested at the present time.Type – To keep it simple, we’re leaving this input blank in the example, meaning the formula will assume that you make your contributions at the end of each period. (If you make contributions at the beginning of each period, you can use “1” as your input.)Now, back in Excel, in cell B5, you had typed: =FV(4. With your cursor blinking after the open parenthesis in cell B5, take your mouse and click on cell B1, which has the value “5%” in it. Then type a comma.Your screen should look like this: 5. With your cursor blinking in cell B5 after the comma, click on cell B2 and type another comma.6. Click on cell B3 and type a comma.7. Click on cell B4 and type a closed parenthesis. Don’t hit enter yet.Your screen should now look like this:

5. With your cursor blinking in cell B5 after the comma, click on cell B2 and type another comma.6. Click on cell B3 and type a comma.7. Click on cell B4 and type a closed parenthesis. Don’t hit enter yet.Your screen should now look like this:

If so, congratulations! You’ve just calculated a future value of $238,356.82 for the portfolio in our example.(The value is negative, but don’t worry about that for now. If you’re really curious about this, feel free to watch some YouTube videos about it or call me.)To estimate the future value of your own portfolio, leave the formula in cell B5 exactly as it is, and replace the values in cells B1, B2, B3 and B4 with the actual or expected values for your own portfolio: Your expected rate of return, the number of years you plan on working until you retire, your expected annual savings, and the present value of your invested savings.Of course all of the figures that you enter into your formula will be forecasts, except for the present value of your savings. There’s no way to know for certain what your rate of return will be in the future, especially if you’re investing in equities. You also can’t be sure of the number of years you’ll be working or how much you’ll be saving each year. You’ll have to get comfortable making educated guesses about an uncertain future.Regardless, using this formula can help you get a ballpark idea of where your investing plan is headed. After you run some calculations, you may find that you’re right on track for where you want to be when it comes time to retire.But you may find that you are not.If that’s the case, you’ll need to re-evaluate your plan, and consider making some changes. It might be hard, but it’s much easier to make a course-correction sooner rather than later. More on that next month.

If so, congratulations! You’ve just calculated a future value of $238,356.82 for the portfolio in our example.(The value is negative, but don’t worry about that for now. If you’re really curious about this, feel free to watch some YouTube videos about it or call me.)To estimate the future value of your own portfolio, leave the formula in cell B5 exactly as it is, and replace the values in cells B1, B2, B3 and B4 with the actual or expected values for your own portfolio: Your expected rate of return, the number of years you plan on working until you retire, your expected annual savings, and the present value of your invested savings.Of course all of the figures that you enter into your formula will be forecasts, except for the present value of your savings. There’s no way to know for certain what your rate of return will be in the future, especially if you’re investing in equities. You also can’t be sure of the number of years you’ll be working or how much you’ll be saving each year. You’ll have to get comfortable making educated guesses about an uncertain future.Regardless, using this formula can help you get a ballpark idea of where your investing plan is headed. After you run some calculations, you may find that you’re right on track for where you want to be when it comes time to retire.But you may find that you are not.If that’s the case, you’ll need to re-evaluate your plan, and consider making some changes. It might be hard, but it’s much easier to make a course-correction sooner rather than later. More on that next month.

Marie Kondo and Your Finances

I love watching TV. I watch Bloomberg in the mornings and I usually cue up a show from Netflix or Amazon Prime after the kids are asleep, to help me unwind.One of my favorite new shows is “Tidying Up with Marie Kondo.” Watching her organize other people’s lives makes me feel calmer. I’ve even gotten into folding clothes the way she does to keep my drawers and closets organized.So, what does this have to do with investing?One of the themes she repeats in each episode is to be willing to part with items you don’t love, and to only keep things that “spark joy.”In that spirit, I recently went through our kitchen drawers (shudder) with the goal of getting rid of any kitchen utensils we’ve accumulated over the years but never use.

- Rolling pin – gone. We are not pizza makers.

- 4th spatula – gone. We’ve got a dishwasher for the other three.

- Backup salad tongs – gone. We haven’t made a salad that requires tossing since 2013.

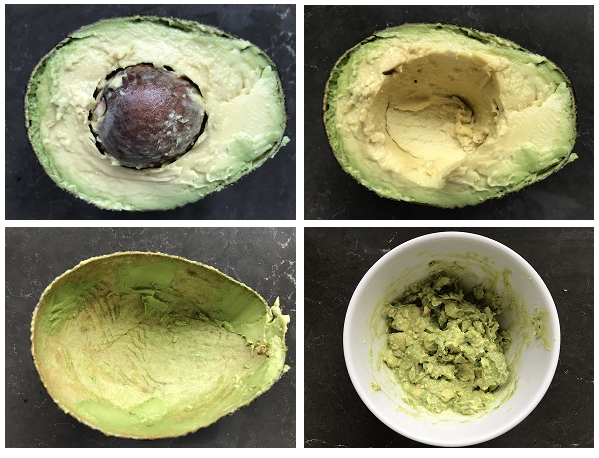

In this liquidation process, I came across a weird instrument I must have glanced over a thousand times but never used: An avocado tool. “Are you kidding,” I thought to myself at first. “An avocado tool? How efficiently do we really need to be pitting our avocados?”But at that exact moment, I noticed we had a perfectly ripe avocado in the fruit bowl, right in front of me. And I was hungry. And we had some chips.So I decided to test this thing out, to see if it sparked enough joy to survive my kitchen purge.Well, I’ll tell you what. It not only made pitting that avocado less of a pain than it normally is when I use a spoon or a knife; it actually made pitting the avocado… a pure delight.I think there are two reasons for this. First, I got all of the avocado out of the skin, off the pit and into a bowl in about 30 seconds.

“Are you kidding,” I thought to myself at first. “An avocado tool? How efficiently do we really need to be pitting our avocados?”But at that exact moment, I noticed we had a perfectly ripe avocado in the fruit bowl, right in front of me. And I was hungry. And we had some chips.So I decided to test this thing out, to see if it sparked enough joy to survive my kitchen purge.Well, I’ll tell you what. It not only made pitting that avocado less of a pain than it normally is when I use a spoon or a knife; it actually made pitting the avocado… a pure delight.I think there are two reasons for this. First, I got all of the avocado out of the skin, off the pit and into a bowl in about 30 seconds. No wasted avocado flesh stuck to the pit or on the skin, no frustration trying to scoop the pit out with a knife or shooting it across the room with a spoon. But there was another reason why the avocado tool made this task so enjoyable:It was the perfect tool for the job, and I already had it. Right there.This reminded me of a financial tool that I routinely recommend to clients, some of whom already have it but don’t think to use it:Their Home Equity Line of Credit (HELOC).The HELOC is a wonderful tool and a huge bonus for home-owners. It allows you to borrow money against the value of your home at rates that are often much lower than those offered for other types of loans.A HELOC is great for a variety of purposes. I’ve recommended it to clients for:

No wasted avocado flesh stuck to the pit or on the skin, no frustration trying to scoop the pit out with a knife or shooting it across the room with a spoon. But there was another reason why the avocado tool made this task so enjoyable:It was the perfect tool for the job, and I already had it. Right there.This reminded me of a financial tool that I routinely recommend to clients, some of whom already have it but don’t think to use it:Their Home Equity Line of Credit (HELOC).The HELOC is a wonderful tool and a huge bonus for home-owners. It allows you to borrow money against the value of your home at rates that are often much lower than those offered for other types of loans.A HELOC is great for a variety of purposes. I’ve recommended it to clients for:

- Starting a small business;

- A home renovation or addition;

- Funding an extended job search or career change;

- An emergency or rainy-day fund.

I would discourage using it for other purposes such as vacations, increased spending, or general consumption.To qualify for a HELOC, you need to have:

- A steady income;

- A good credit score;

- At least 20% equity in your house (in Texas -- some other states require only 15%).

A HELOC is basically just a great way to get a loan at rates that are much lower than most credit cards.

And that seems like it could spark some serious joy.

***

If you haven’t seen Marie Kondo’s show yet, you can get a sense of her calming presence in this 2-minute video.

The Most Important Attribute Your Advisor Can Have

Three weeks ago, several people forwarded me the New York Times op-ed “Consider Firing Your Male Broker,” written by Blair duQuesnay. With a title like that, it’s hard not to click on the link.After reading the article, I did a little digging and discovered that The New York Times chose the provocative title for the piece, not the author herself.While the newspaper was probably trying to attract eyeballs by intentionally setting a gender-war type tone, I think it may have skewed the underlying message of the article. The title speaks to individual investors: “If your financial advisor is male, you should consider firing him because of the following reasons.” But the article itself is directed towards financial advisory firms and the dearth of female advisors in the field.The author presents research showing that women often make better investors than men. She cites multiple studies in which, over the course of several years, female investors earned higher returns than male investors. In explaining these findings, researchers asserted that male investors are more likely to be overconfident, to engage in riskier investments, and to pick investments based on the “thrill” of investing than female investors.Ms. duQuesnay also provides anecdotal evidence from her own experience, relating her clients’ stories of previous male advisors who were unavailable, unresponsive, looking out for their own interests rather than those of their clients, or condescending mansplainers.I think it’s because of this anecdotal section of the article that the Times chose a title aimed at individual investors. After all, most of the Times’ readers are presumably individuals with retirement accounts.However, the author’s real message was directed towards the decision makers at large advisory firms in regards to the shortage of women in financial advisory roles. Fewer than 20% of financial advisors in the U.S. are female, and Ms. duQuesnay writes that financial advisory firms should modify their hiring practices to rectify this imbalance.To her broader point about the gender imbalance in financial advising and the path forward for hiring more female advisors, I agree wholeheartedly. Women must be given equal opportunities to pursue careers in wealth management, and the studies presented in this article show that women are good investors.However, my strongest reaction was to the passage recounting her clients’ horror stories about their previous financial advisors. And this is where I have a minor bone to pick with the newspaper over the title of the article.Anyone who has a financial advisor who is unavailable, condescending, recommending investments that pay the advisor a high commission, or choosing investments that are riskier than the client is comfortable with should consider changing advisors, regardless of the advisor’s gender. As the author herself points out, “neither sex is immune to shoddy behavior.”Clear communication, respect, and trust are the absolute bedrock of the relationship between a client and an advisor. Anyone interviewing prospective advisors should make those the attributes they are looking for.

Endurance, Compounding & the Bear Market

When stocks fall by -20% from their highs, it’s called a “bear market.” The S&P 500 fell from a high of around 2925 in October to a low around 2351 on Christmas Eve. Most of us were calling the -19.6% decline a bear market, even if it hadn’t officially fallen 20% (yet). If you’re a stickler for the rules, then you only have to look at the tech-heavy Nasdaq for an official bear market -- from August 30 to December 24 it fell -23.9%.This is very sobering for investors, and like many of you, I found the topic dominating my holiday conversations. But I also found a little time to put work out of my mind by picking up a great book.“Endurance” is the true story of Sir Ernest Shackleton, who sailed for Antarctica in 1915 on a mission to become the first person to cross the then-unexplored continent. But before he reached land, his ship became stuck in an ice floe, and so began an extraordinary story of survival and perseverance. For 10 months, Shackleton and his 27-man crew fought to stay alive and make it back home. After getting stuck, the boat was eventually crushed to pieces by the huge grinding ice floes. Without shelter and unable to safely cross the floes by boat, sled or foot, the men had to make camp on the ice and wait for the winds and ocean currents to slowly move them north. As the months went by, boredom set in as they sat with nothing to do, waiting for the wind to blow them toward dry land.The boredom was punctuated by moments of acute, paralyzing fear. Sea leopards 10 feet long would stalk men walking on the ice. Ice floes would crack open and dump men and supplies into the freezing water. The crew tried to escape on life rafts, but savage storms battered the tiny boats out on the open sea for days on end. Battling starvation and sleep-deprivation, most of them reached the point where they just wanted the agony to be over, one way or another.In the stock market, that feeling of just wanting the agony to be over is called “capitulation.”Capitulation convinces you to sell when prices are low, even if selling low means locking in losses. Capitulation is a financial plan’s most destructive enemy, and it’s the one I try to avoid at all costs.Bear markets can last months or years. They can cause emotional, mental and even physical anguish. During bear markets it’s easy to forget why we are investing in stocks in the first place.So what is our “why”?Compounding. Compounding is how investments grow over time. The longer you stay invested, the better your chances of seeing big gains in your portfolio.The power of compounding is difficult to understand when times are good, and it’s nearly impossible to remember when times are bad. But having the patience and resolve to endure bear markets is the only way to consistently reap the benefits of compounding.Visualizing the power of compounding for my clients is probably my most important job. It helps me stick to the plan and avoid capitulation when the markets tumble. It allows me to look forward 10 years and envision the possibility that a portfolio has doubled in size. I envision the freedom and peace of mind the client might have then because of the decisions we make today.To survive this bear market and all the others to follow, the first thing you’ll need is a good long-term plan that allows you to harness the power of compounding for your portfolio. Once you’ve got that, you’ll just need the patience and endurance to let it work.By the way, Shackleton and his men survived. Every single one.* * *And if you’ve never seen a sea leopard, I encourage you to watch this short video of biologist Lisa Kelly and her new friend. I can almost guarantee it will make your day.

After getting stuck, the boat was eventually crushed to pieces by the huge grinding ice floes. Without shelter and unable to safely cross the floes by boat, sled or foot, the men had to make camp on the ice and wait for the winds and ocean currents to slowly move them north. As the months went by, boredom set in as they sat with nothing to do, waiting for the wind to blow them toward dry land.The boredom was punctuated by moments of acute, paralyzing fear. Sea leopards 10 feet long would stalk men walking on the ice. Ice floes would crack open and dump men and supplies into the freezing water. The crew tried to escape on life rafts, but savage storms battered the tiny boats out on the open sea for days on end. Battling starvation and sleep-deprivation, most of them reached the point where they just wanted the agony to be over, one way or another.In the stock market, that feeling of just wanting the agony to be over is called “capitulation.”Capitulation convinces you to sell when prices are low, even if selling low means locking in losses. Capitulation is a financial plan’s most destructive enemy, and it’s the one I try to avoid at all costs.Bear markets can last months or years. They can cause emotional, mental and even physical anguish. During bear markets it’s easy to forget why we are investing in stocks in the first place.So what is our “why”?Compounding. Compounding is how investments grow over time. The longer you stay invested, the better your chances of seeing big gains in your portfolio.The power of compounding is difficult to understand when times are good, and it’s nearly impossible to remember when times are bad. But having the patience and resolve to endure bear markets is the only way to consistently reap the benefits of compounding.Visualizing the power of compounding for my clients is probably my most important job. It helps me stick to the plan and avoid capitulation when the markets tumble. It allows me to look forward 10 years and envision the possibility that a portfolio has doubled in size. I envision the freedom and peace of mind the client might have then because of the decisions we make today.To survive this bear market and all the others to follow, the first thing you’ll need is a good long-term plan that allows you to harness the power of compounding for your portfolio. Once you’ve got that, you’ll just need the patience and endurance to let it work.By the way, Shackleton and his men survived. Every single one.* * *And if you’ve never seen a sea leopard, I encourage you to watch this short video of biologist Lisa Kelly and her new friend. I can almost guarantee it will make your day.

Cash or Stocks, Depending on the Season

The seasons are changing, and so are the markets.Some of you may be pleased to know that, after years of near-zero interest rates, you can finally get decent rates on your cash savings.I never notice the seasons changing. In my defense, Austin is not a place where the seasons change all that much.And with work, kids, and trying to carve out some time for myself every once in a while, my mind is always working on something and I don’t really notice the scenery around me.But during the long Thanksgiving weekend last month, I had a few days to really slow down. I read a book that wasn’t about finance or economics. I exchanged thoughts with my visiting father-in-law about Catherine the Great (a quirky, shared interest). And on a walk to the park with the girls, I looked up and realized that many trees in our neighborhood had changed colors. My sister in Illinois sent me pictures of her trees, as a point of comparison. Not a huge surprise that on Thanksgiving the trees up there looked different than the trees down here:

My sister in Illinois sent me pictures of her trees, as a point of comparison. Not a huge surprise that on Thanksgiving the trees up there looked different than the trees down here: In Austin, it can be hard to notice the seasons changing. It gets very cold for a few days, then the sun comes out and it warms up, then it rains and blows, then who knows. In northern Illinois, it’s usually pretty easy to tell when winter has arrived. It gets cold, and then it stays cold.It reminds me what it’s like for investors trying to figure out if and when the markets have taken a turn.Sometimes it’s easy to know when the markets have turned in a different direction, for better or for worse. Most of the time, it’s hard to know.This has been an interesting year for the markets. U.S. stocks have basically gone sideways. The housing market is slowing in much of the country. Yields on bonds have gone up by quite a bit. No one knows whether these changes signal the first signs of the next recession or just a pause before things start chugging up again.Investors have to deal with uncertainty all the time. Many investors are saving for a long-term goal like retirement, and last month I wrote an article about staying the course with long-term investments during a market correction. I still think that if you have a part of your portfolio that needs to grow over 10, 20 or 30+ years, it’s a good idea to stay in stocks for the long run.But this month, I have a tip for those of you whose goals are more short-term. Whether you’re saving up for an emergency fund, planning an upcoming home purchase, or making withdrawals in retirement, this is a great time to seek out better rates on cash savings.Short-term rates are finally getting interesting. For example, today TD Ameritrade (my custodian) has listed a 12-month FDIC insured CD at a 2.7% yield and a 24-month FDIC insured CD at a 3.05% yield. You can check your own bank or custodian to see if they are offering higher rates, too. Now’s a great time to do some comparison shopping.If there’s some portion of your portfolio that needs to hunker down and hibernate during these chilly, volatile months in the stock market, CDs might be a nice respite from the cold.

In Austin, it can be hard to notice the seasons changing. It gets very cold for a few days, then the sun comes out and it warms up, then it rains and blows, then who knows. In northern Illinois, it’s usually pretty easy to tell when winter has arrived. It gets cold, and then it stays cold.It reminds me what it’s like for investors trying to figure out if and when the markets have taken a turn.Sometimes it’s easy to know when the markets have turned in a different direction, for better or for worse. Most of the time, it’s hard to know.This has been an interesting year for the markets. U.S. stocks have basically gone sideways. The housing market is slowing in much of the country. Yields on bonds have gone up by quite a bit. No one knows whether these changes signal the first signs of the next recession or just a pause before things start chugging up again.Investors have to deal with uncertainty all the time. Many investors are saving for a long-term goal like retirement, and last month I wrote an article about staying the course with long-term investments during a market correction. I still think that if you have a part of your portfolio that needs to grow over 10, 20 or 30+ years, it’s a good idea to stay in stocks for the long run.But this month, I have a tip for those of you whose goals are more short-term. Whether you’re saving up for an emergency fund, planning an upcoming home purchase, or making withdrawals in retirement, this is a great time to seek out better rates on cash savings.Short-term rates are finally getting interesting. For example, today TD Ameritrade (my custodian) has listed a 12-month FDIC insured CD at a 2.7% yield and a 24-month FDIC insured CD at a 3.05% yield. You can check your own bank or custodian to see if they are offering higher rates, too. Now’s a great time to do some comparison shopping.If there’s some portion of your portfolio that needs to hunker down and hibernate during these chilly, volatile months in the stock market, CDs might be a nice respite from the cold.